- Publication: MIT & UBS

- Publication Date: 2023

- Organizations mentioned: UBS Group, Rizal Commercial Banking Corporation (RCBC), Visa, PayPal, JPMorgan Chase

- Publication Authors: Paul Kielstra

- Technical background required: Low

- Estimated read time (original text): 50 minutes

- Sentiment score: 65%, Somewhat positive

TLDR

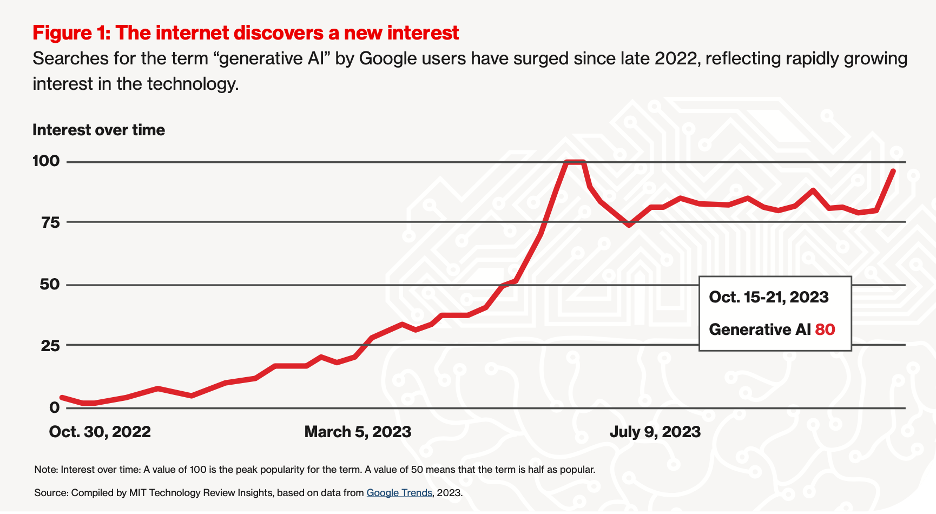

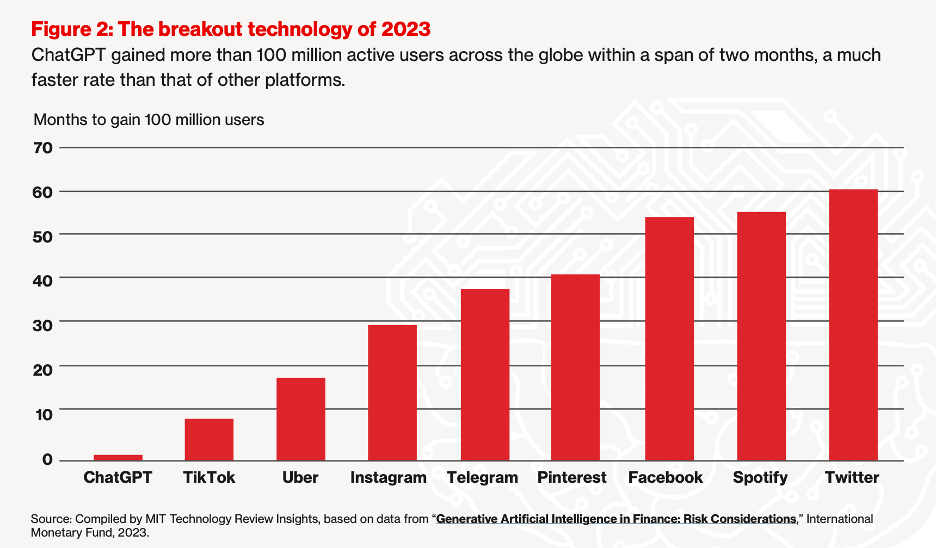

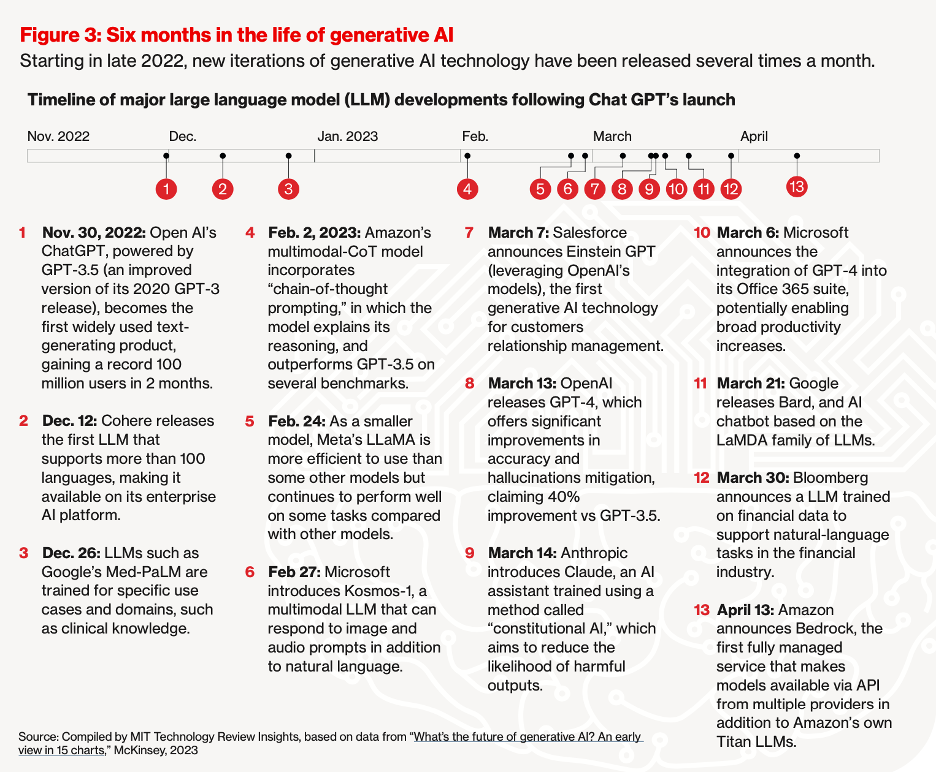

Goal: This report, published by MIT in partnership with UBS, explores the impact of generative AI in the financial sector. It aims to understand how this technology is currently being used, the challenges faced in its deployment, and the potential barriers to its broader adoption. The context for this study is rooted in the growing importance of AI in transforming business operations and the specific curiosity about its role in finance.

Methodology:

- The study employed qualitative research, including interviews with senior executives and experts in the field.

- It focused on real-world applications of generative AI in the financial sector, analyzing both successes and challenges.

- The report synthesized information from various industry leaders and academic sources to offer a comprehensive view of the current state and future prospects of AI in finance.

Key Findings:

- Generative AI presents a potential annual value of $340 billion in the financial sector, primarily through efficiency gains and customer service improvements.

- Major barriers to AI adoption include ethical concerns, data privacy issues, and the need for significant investment in technology and training.

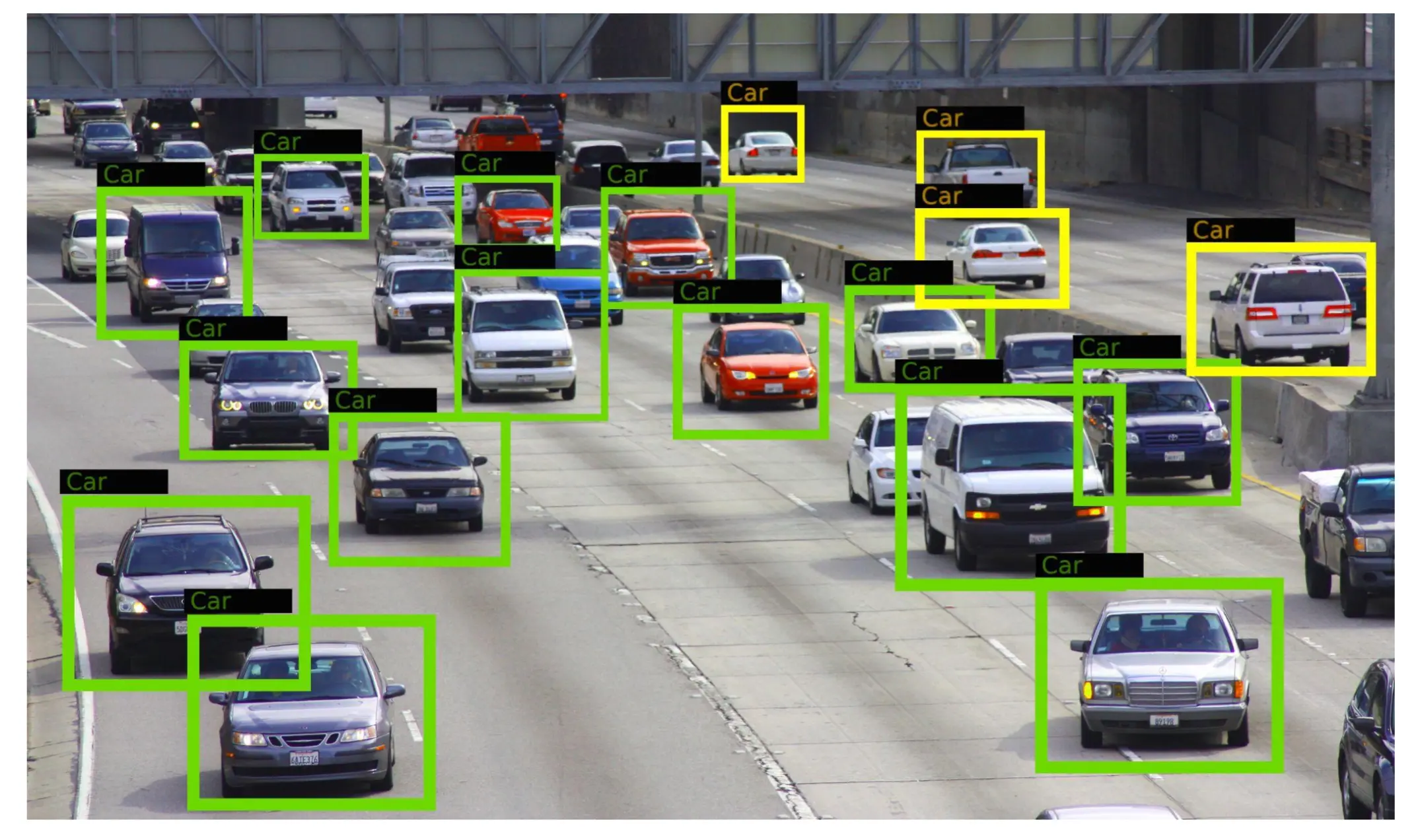

- AI’s impact is most notable in areas like fraud detection, personalized customer experiences, and risk management.

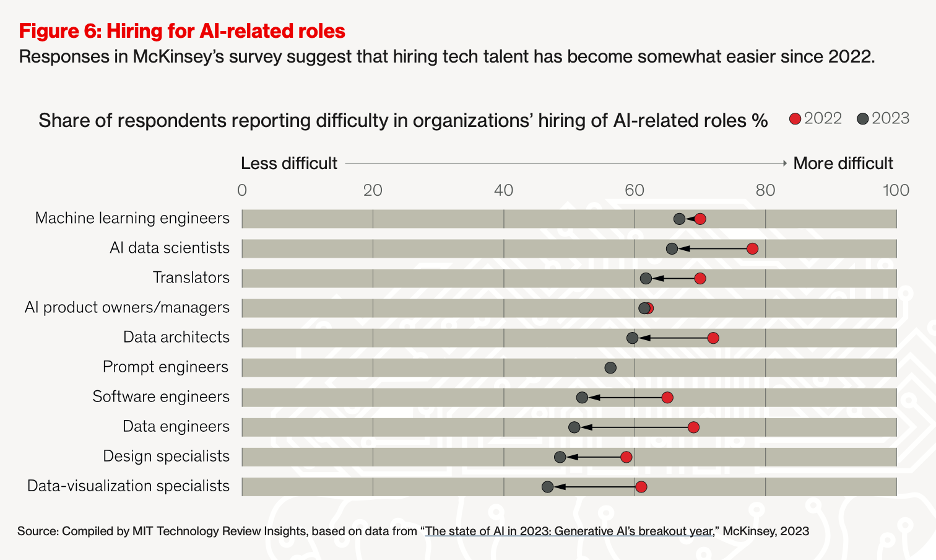

- There is a notable talent gap in the industry, with a need for more skilled professionals in AI and data analytics.

- The use of generative AI for more sensitive and core tasks in financial services, such as managing or executing investment strategies, is still some distance away from becoming a reality.

Recommendations:

- Financial institutions should prioritize ethical AI practices, ensuring transparency and fairness in AI-driven decisions.

- Continued investment in AI research and development is essential for staying competitive in the evolving financial landscape.

- Firms should focus on developing AI literacy and skills among their workforce to bridge the talent gap.

- Collaborations between financial institutions and technology companies can accelerate AI adoption and innovation.

- Regulatory frameworks need to evolve to address the challenges and risks associated with AI in finance.

Thinking critically

Implications:

- If financial organizations universally adopt AI as recommended, this could lead to significant efficiency gains, innovation in customer service, and robust fraud detection systems. However, this could also lead to job displacement in traditional roles and raise ethical concerns regarding decision-making transparency.

- A failure to embrace AI could see financial institutions fall behind in competitiveness, customer satisfaction, and risk management. This could result in a market where AI-adopting firms dominate, potentially creating monopolies.

- The recommendations around ethical AI and evolved regulatory frameworks imply a need for a balance between innovation and responsible AI usage. This balance is crucial for maintaining public trust and ensuring fair financial practices.

Alternative Perspectives:

- The report’s reliance on qualitative interviews may not fully represent the diverse range of views within the industry, potentially overlooking critical concerns or alternative strategies.

- The report’s optimistic view on AI’s potential value could underestimate the complexities and challenges in practical implementation, such as integrating AI into legacy systems.

- The report might underestimate the time and complexity involved in evolving regulatory frameworks to suit AI advancements, potentially delaying AI adoption.

AI Predictions:

- Based on the report’s findings, it’s likely that AI will be incrementally integrated into less sensitive areas of finance before tackling core business tasks.

- The industry will likely witness the emergence of new job roles centered around AI ethics, compliance, and integration.

- The need for AI literacy and talent will likely foster collaborations between financial institutions and tech firms, leading to innovative AI-driven financial products and services.

Glossary

- Multimodal LLM: A type of large language model that can process and generate multiple forms of data, such as text, images, and sounds.

- Automation: The use of technology, particularly AI, to perform tasks without human intervention.

- Deep Learning: A subset of machine learning involving algorithms inspired by the structure and function of the brain’s neural networks.

- Bias: In AI, this refers to prejudiced outcomes generated by algorithms, often due to biased data inputs.

- Accountability: The responsibility and traceability of actions and decisions made by AI systems.

- Hallucination: A phenomenon where AI generates false or misleading information, often due to limitations in understanding context or data.

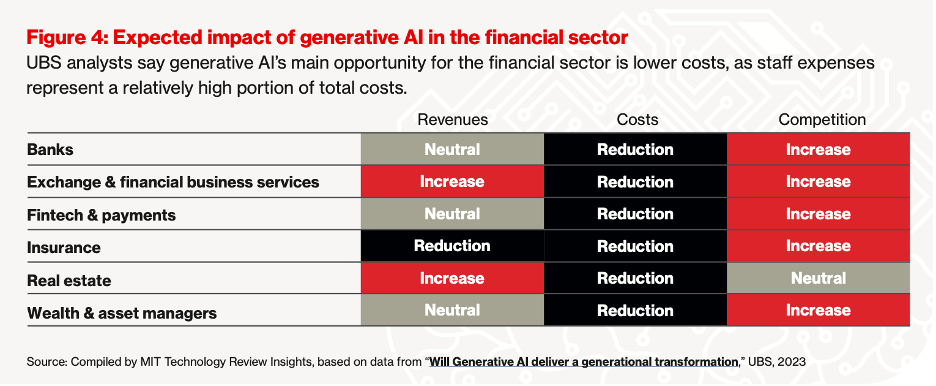

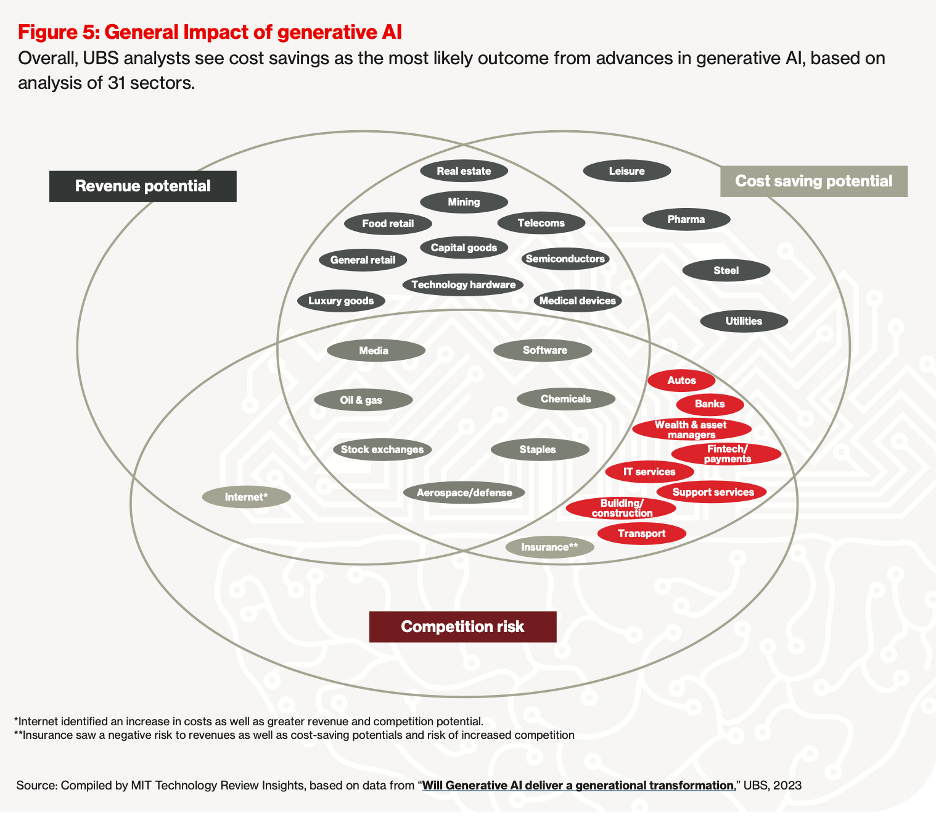

Figures

Members also get access to our comprehensive database of AI tools and fundraising

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!