- Publication: Goldman Sachs

- Publication Date: June 25, 2024

- Organizations mentioned: Goldman Sachs, Microsoft, Nvidia, MIT, Amazon

- Publication Authors: Allison Nathan, Jenny Grimberg, Ashley Rhodes

- Technical background required: Medium

- Estimated read time (original text): 120 minutes

- Sentiment score: 55%, neutral

TLDR:

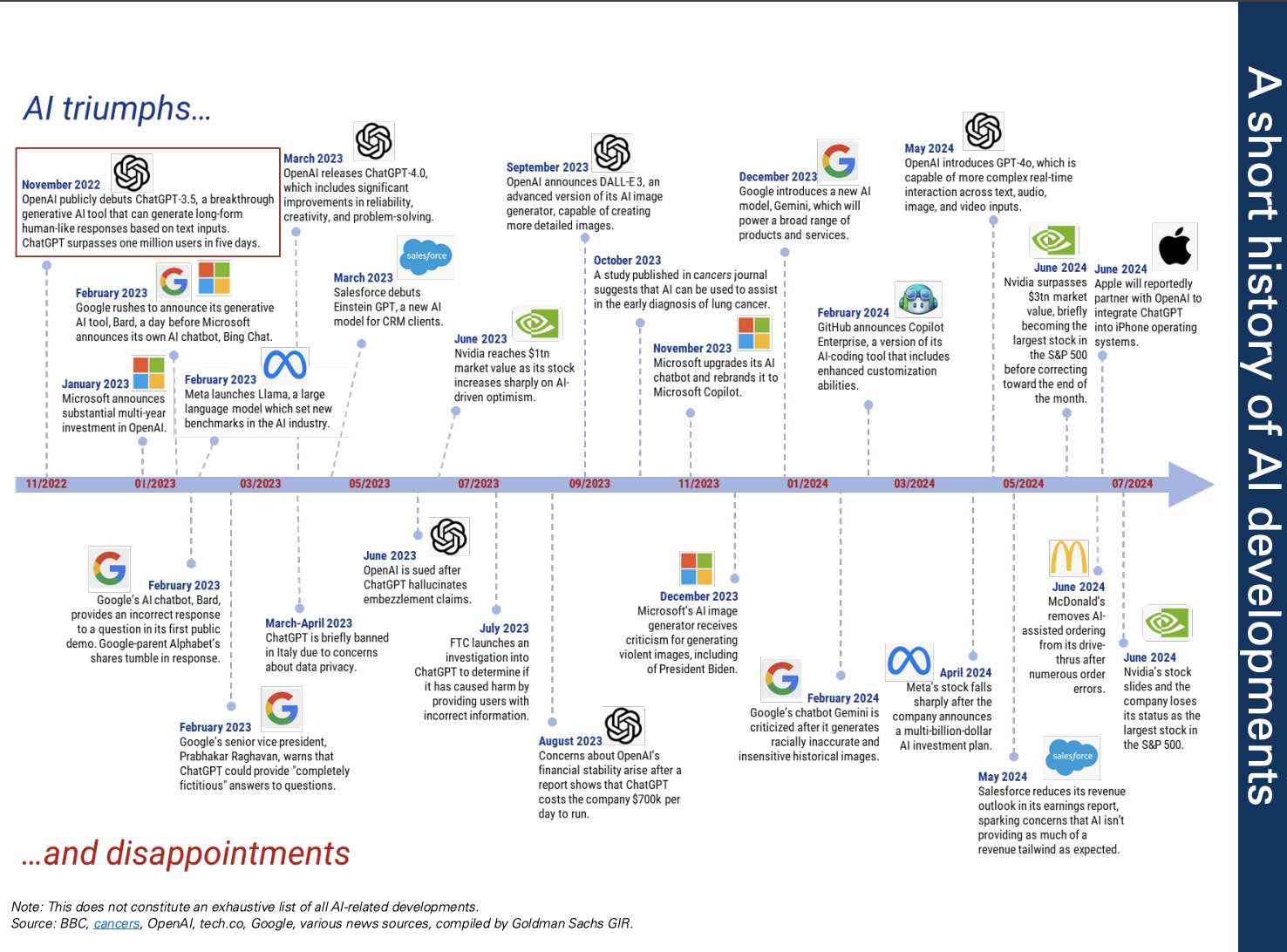

Goal: Goldman Sachs Global Investment Research produced this report to examine the economic potential and challenges of generative AI technology. The analysis was prompted by the estimated $1 trillion investment in AI infrastructure by tech giants and other companies, despite limited tangible benefits so far. The report aims to assess whether this substantial spend will ultimately pay off in terms of AI benefits and returns.

Methodology:

- The report combines expert interviews, economic analysis, and industry insights to provide a comprehensive view of AI’s potential impact.

- It examines various scenarios for AI adoption, productivity gains, and economic growth, using both optimistic and skeptical perspectives.

- The analysis incorporates data on current AI investments, power demand projections, and semiconductor industry constraints.

Key findings:

- There is significant debate about AI’s economic impact. MIT economist Daron Acemoglu estimates only a 0.5% increase in US productivity and 0.9% increase in GDP over the next decade, while Goldman Sachs economists forecast a 9% productivity boost and 6.1% GDP growth.

- The high cost of AI technology is a major concern. Jim Covello, Head of Global Equity Research at Goldman Sachs, argues that AI must solve complex problems to justify its costs, which it currently isn’t designed to do.

- Power demand from AI and data centers is expected to surge. US electricity demand is projected to rise at a 2.4% compound annual growth rate from 2022-2030, with data centers accounting for about 90 basis points of that growth.

- The semiconductor industry faces supply constraints in High-Bandwidth Memory (HBM) technology and Chip-on-Wafer-on-Substrate (CoWoS) packaging, which may limit AI growth over the next few years.

- Despite concerns, many experts remain optimistic about AI’s long-term potential. Kash Rangan and Eric Sheridan, Goldman Sachs analysts, believe the large AI spend will eventually pay off, even as AI’s “killer application” has yet to emerge.

- The utilities sector is emerging as a potential beneficiary of the AI boom, with expectations of significant infrastructure investment to meet growing power demands.

Recommendations:

- Investors should remain cautious but engaged with AI-related investments. While the “picks and shovels” companies exposed to AI infrastructure have already seen significant gains, there may be room for further growth.

- Companies should carefully evaluate their AI strategies and investments, balancing the potential benefits against the high costs and uncertain returns.

- Policymakers and utilities should prepare for a significant increase in power demand, potentially requiring substantial investments in grid infrastructure and new generation capacity.

- The semiconductor industry should focus on addressing supply constraints in critical components like HBM and CoWoS to support continued AI growth.

- Investors and analysts should closely monitor the development of AI applications across various industries, as the emergence of a “killer app” could significantly impact the technology’s economic potential.

Thinking Critically:

Implications:

- If organizations widely adopt AI technologies despite the high costs and uncertain returns, it could lead to a significant reshaping of the global economy. This could result in increased productivity in some sectors but also potential job displacement and widening economic inequality if the benefits are not evenly distributed.

- The projected surge in power demand from AI and data centers could accelerate the transition to renewable energy sources and spur major investments in grid infrastructure. This could create new opportunities in the utilities sector but also pose challenges for regions struggling to meet the increased energy requirements.

- If the semiconductor industry fails to address the supply constraints in critical AI components, it could slow down the pace of AI adoption and innovation globally. This might create a competitive advantage for countries or companies that can secure access to these limited resources.

Alternative perspectives:

- The report’s focus on near-term economic impacts may underestimate the long-term transformative potential of AI. Historical examples of technological revolutions suggest that the most significant impacts often take decades to materialize and can be difficult to predict in early stages.

- The analysis may not fully account for potential breakthroughs in AI efficiency or alternative architectures that could dramatically reduce costs and energy requirements. Developments in neuromorphic computing or quantum AI could potentially change the cost-benefit calculations presented in the report.

- The report’s emphasis on GDP and productivity as primary measures of AI’s impact may overlook other important factors, such as improvements in healthcare outcomes, scientific research, or quality of life that are harder to quantify but potentially more significant in the long run.

AI predictions:

- Within the next five years, we will see the emergence of at least one “killer application” for AI that demonstrates clear, cost-effective benefits in a specific industry, likely in healthcare, finance, or scientific research.

- The power demand issue will lead to a new wave of innovation in energy-efficient AI hardware and software, with companies achieving order-of-magnitude improvements in performance per watt within the next decade.

- Geopolitical tensions will increasingly center around access to AI technologies and the raw materials needed for their development, leading to new international agreements and conflicts over tech transfer and resource allocation by 2030.

Glossary:

- IPA progression: Infrastructure first, platforms next, and applications last – the typical progression of computing cycles according to the report.

- Electrification Compounders: Utilities that primarily grow profits from power grids and renewables, identified as main beneficiaries of rising power demand.

- AI-first company: A term used to describe companies like Alphabet that have prioritized AI in their strategy and operations.

- Phase 1-4 of the AI trade: A framework describing the progression of AI investment, from Nvidia (Phase 1) to AI infrastructure (Phase 2) to AI-enabled revenues (Phase 3) to widespread AI adoption and productivity gains (Phase 4).

- Picks and shovels companies: Firms directly benefiting from the AI infrastructure buildout, such as semiconductor manufacturers and cloud providers.

- AI bubble: The notion that current AI investments and valuations may be unsustainably high, similar to past tech bubbles.

Members also get access to our comprehensive database of AI tools and fundraising

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!