- Publication: Cognizant

- Publication Date: 2023

- Organizations mentioned: Google, Microsoft, Amazon Web Services, JPMorgan Chase & Co., Mastercard

- Publication Authors: Ed Merchant, Susan Rickard, Craig Weber, Manan Gauba

- Technical background required: Low

- Estimated read time (original text): 40 minutes

- Sentiment score: 75%, somewhat positive (100% being most positive)

The report examines the impact of generative AI in the banking, financial services, and insurance sectors. It explores how these industries can leverage AI for opportunities and mitigate associated risks.

TLDR

Goal:

This report by Cognizant investigates the transformative effects of generative AI in the banking, financial services, and insurance sectors. It aims to understand how these industries can capitalize on AI’s potential while mitigating emerging risks, particularly in the context of rapid technological advancements and increasing reliance on AI solutions.

Methodology:

- The study uses a combination of industry analysis, expert interviews, and case studies to understand the applications and implications of generative AI in finance.

- It includes a thorough examination of current AI technologies, their adoption levels, and their impact on various financial services functions.

- The report also explores potential future developments and challenges in implementing AI in the financial industry.

Key Findings:

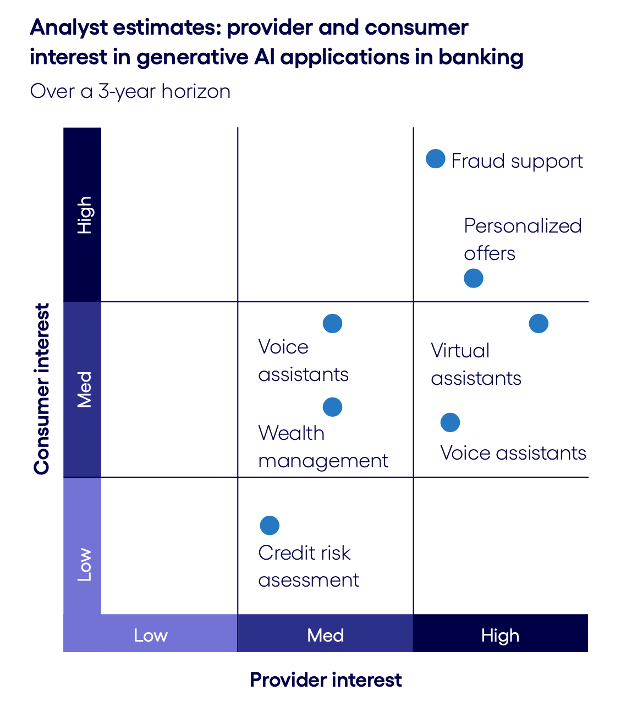

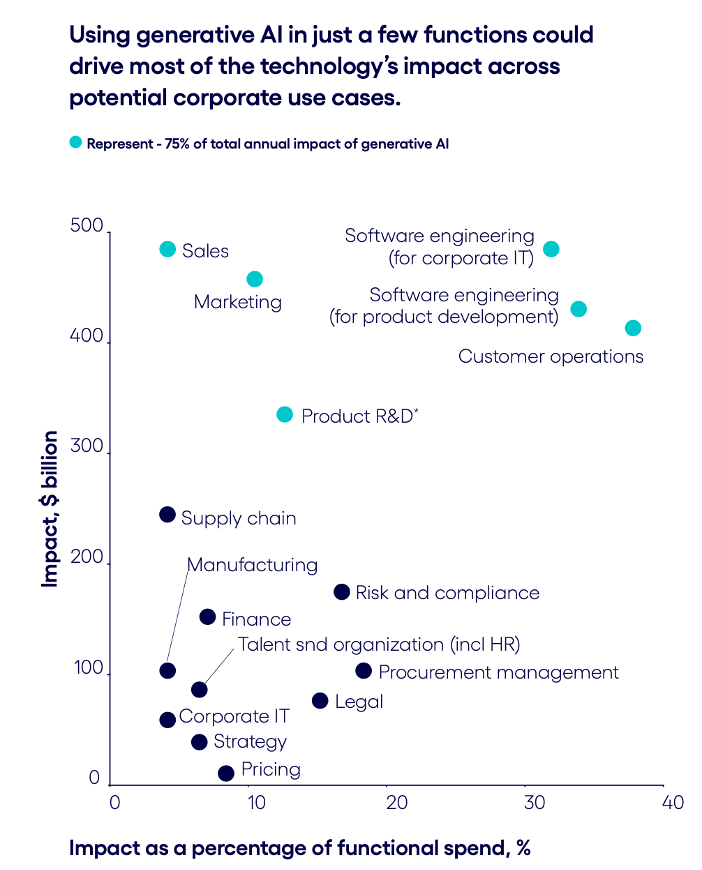

- Generative AI is significantly enhancing process automation, customer service, and risk analysis in finance, leading to increased efficiency and reduced costs.

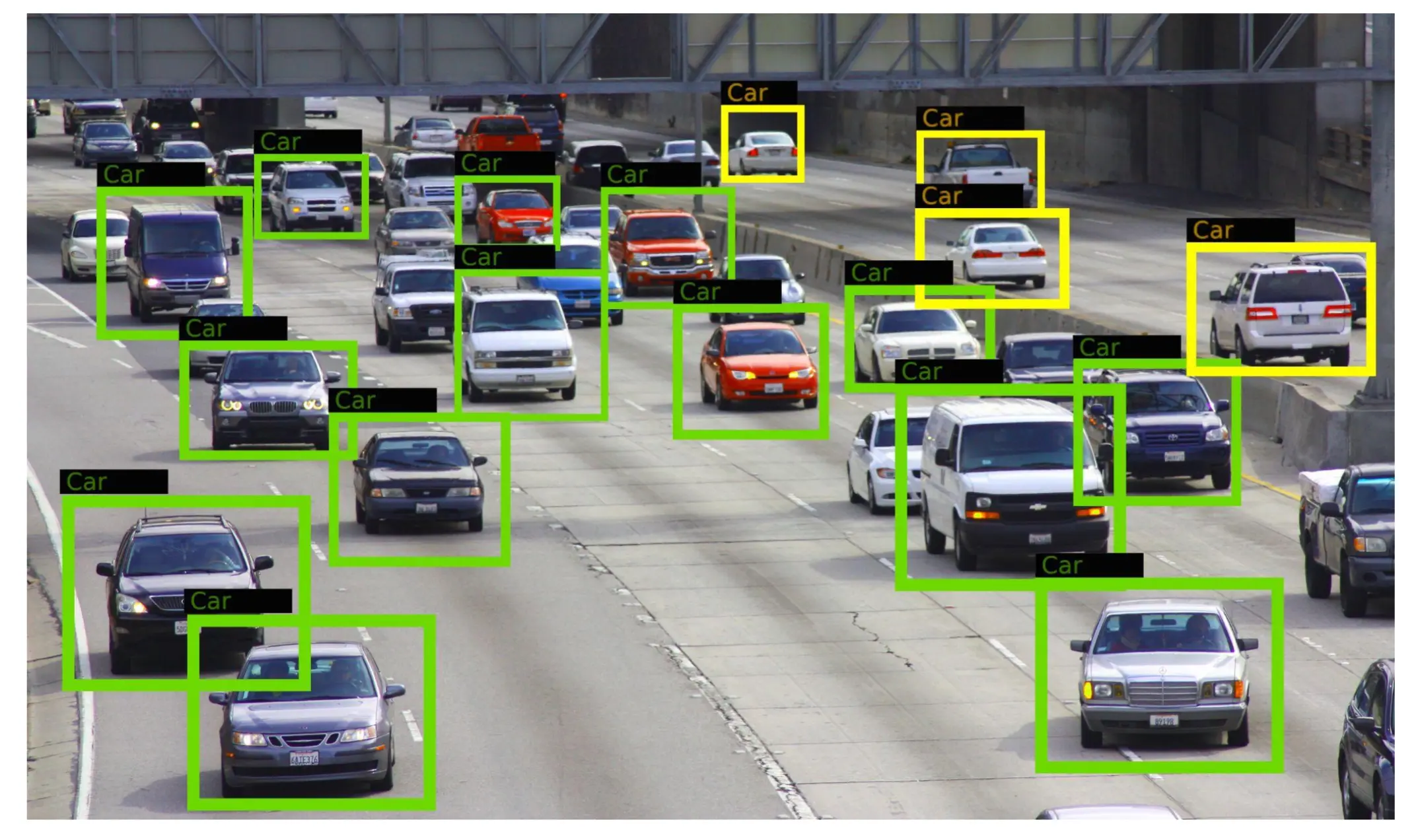

- There’s a growing trend of AI applications in fraud detection and data management, suggesting a shift towards more proactive risk mitigation strategies.

- Despite the advantages, there are challenges in AI integration, including regulatory compliance, ethical considerations, and the need for skilled workforce.

- The financial sector is witnessing an increased collaboration between traditional financial institutions and tech companies in AI development and application.

- AI is playing a critical role in personalizing customer experiences and offering innovative financial products and services.

Recommendations:

- Financial institutions should invest in AI literacy and training for their workforce to harness the full potential of AI technologies.

- There is a need for robust regulatory frameworks to ensure ethical AI usage and data protection in the financial sector.

- Companies should focus on developing AI strategies that align with their business goals and customer needs.

- Collaboration between financial institutions and technology companies is recommended to drive innovation and manage AI-related risks effectively.

- Continuous monitoring and adaptation to the evolving AI landscape is crucial for staying competitive in the financial services industry.

Thinking Critically

Implications:

- The widespread adoption of AI in finance could lead to significant efficiency gains, cost reductions, and enhanced customer experiences.

- Integration of AI in the financial industry would accelerate digital transformation, potentially widening the gap between AI-adopting and non-adopting organizations, thus impacting market competition.

- The implementation of AI in finance poses socio-economic challenges, including workforce displacement due to automation and ethical concerns regarding data use.

Alternative Perspectives:

- Critics might argue that the report underestimates the challenges of AI integration, such as the complexities of regulatory compliance and the potential for AI biases, which could lead to unintended negative consequences.

- The optimism about AI’s transformative potential in finance might be tempered by concerns over data privacy, security, and the risk of over-reliance on technology, suggesting a need for more cautious, balanced approaches.

- There could be skepticism about the feasibility of collaboration between financial institutions and tech companies, considering competitive interests and differing organizational cultures.

AI Predictions:

- AI will likely become a key differentiator in financial services, with early adopters gaining a competitive advantage through improved customer experiences and operational efficiencies.

- The evolution of AI in finance may lead to new regulatory frameworks specifically designed to address the unique challenges posed by AI, such as ethical AI use and data protection.

- There will likely be an increase in specialized AI roles within the financial sector, focusing on AI strategy, ethics, and collaboration between tech and financial industries.

Glossary

- Generative AI: AI technologies that can generate new content, including text, images, and simulations.

- Process Automation: The use of technology to automate complex business processes.

- Risk Analysis: Assessment of the financial uncertainties and potential threats to a company.

- Fraud Detection: The process of identifying fraudulent activities, particularly in financial transactions.

- Data Management: The practice of collecting, keeping, and using data securely, efficiently, and cost-effectively.

- AI Literacy: The knowledge and understanding of AI principles and applications.

Figures

Members also get access to our comprehensive database of AI tools and fundraising

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!

Join hosts Anthony, Shane, and Francesca for essential insights on AI's impact on jobs, careers, and business. Stay ahead of the curve – listen now!